Beneficial Owner INFORMATION Report Filing Guide

Last Updated: Jun 27, 2024

THIS GUIDE IS FOR EDUCATIONAL PURPOSES ONLY AND IS NOT LEGAL ADVICE

IF YOU DESIRE LEGAL ADVICE, CONSULT WITH AN ATTORNEY

Who is this guide for?

IMPORTANT — This guide is intended only for simple small business with a few clearly defined owners. If that describes your business, then filing your Beneficial Owner Information Report should be relatively straightforward and you should be able to do it yourself without needing to pay someone to do it. It will take you about 15 mins once you have all the information you need and there is no filing fee.

If your business is more complicated than that (such as other business entities as owners, shell companies, large number of owners, passive investors, or is a trust) then this guide is not for you, and you will need to get help from an attorney.

If you need help with your Beneficial Owner Information Report or want us to file it for you, we can help you with that for a fee. Just send us an email at contact@wolfeboschlaw.com

What is this and why do I need to do it?

What is the Beneficial Owner Information Report?

Starting in 2024, the Corporate Transparency Act (“CTA”) requires (almost) all businesses to provide identifying information for all “Beneficial Owners” of the business to the Financial Crimes Enforcement Network (“FinCEN”). This is information is provided by filing a Beneficial Owner Information Report (“BOI Report“ or “BOIR") with FinCEN. This information is used to prevent and prosecute financial crimes (such as money-laundering).

NOTE: This is completely unrelated to your taxes and is likely not something your accountant filed for you.

What Businesses need to Do this?

Chances are your business needs to do this. Every business entity filed with a state (such as an LLC, LLP, or Corporation) is required to do this. The only notable exception is that Sole Proprietorships do not need to file a BOI Report.

There are some industries that are exempt from filing a BOIR (such as non-profits, banks, or accounting firms)—but these are typically industries that are heavily regulated and have already provided this information. Unless you are 100% certain you are exempt, you should probably file a BOI Report anyway just to be safe. You can see a full list of exempt industries HERE.

If you have questions on wether or not your business is exempt, ask an attorney.

Who is Considered a “Beneficial Owner”?

So who needs to be included in the BOI Report? A “Beneficial Owner” is an individual or entity that either:

Owns or controls at least 25% of the business

OR Exercises “Substantial Control” over the business

So for most small businesses, this should be relatively straightforward to figure out. If you have a mom & pop shop owned with two equal owners, then both owners would be considered Beneficial Owners. If you are solo entrepreneur with an LLC, then you are the only Beneficial Owner.

However, just because someone is not an equity owner in a business does not mean they are not a Beneficial Owner. Individuals (such as a CEO) that exercise “Substantial Control” may be considered a Beneficial Owner for the purposes of this report and must be included. If you are uncertain if someone is a Beneficial Owner or not, ask an attorney.

WHEN DO IT NEED TO FILE IT BY?

If your business was created prior to Jan 1st, 2024, then you have until Dec 31st, 2024 to file your initial BOI Report.

If your business was created on or after Jan 1st, 2024, then you have 90 days from the date your entity was created to file your initial BOI Report.

Starting in 2025, businesses will have only 30 days from date of creation to file an initial BOI Report.

How Often Do I need to File?

This is not a filing you need to do every year. Once you file your initial BOI Report, you are only required to report any changes in the information reported in your initial filing. This includes changes such as:

Change in business name, address, DBAs

Addition or removal of Beneficial Owners (new owners, death of owner, new role of “Substantial Control”)

Changes to Beneficial Owners personal information such as:

Change in name (from marriage or divorce)

New Residential Address (an owner moves)

New Government ID

These changes must be reported within 30 days by filing a new BOI Report with FinCEN.

What if I don’T do this?

Failure to file your BOI Report or providing false information in your report could result in severe punishments including:

Fines up to $500/day

Up to 2 years in jail

So needless to say, please file your Beneficial Owner Information Report!

WHAT IF I OWN MULTIPLE BUSINESSES? - FinCEN ID# PROFILE

Each business you are a Beneficial Owner of will need to file a BOI Report and you will need to provide your information each time.

If you own multiple businesses, and want to save yourself some time, you can register for a FinCEN ID#. This will create a profile with FinCEN that will allow you to upload and manage your information yourself which saves you from having to provide your information and drivers license multiple times for multiple businesses. When asked to provide your information for a BOI Report, you can just give your FinCEN ID# that links back to your profile.

If you would like to obtain a FinCEN ID#, you can apply for one HERE.

If you are not an owner of multiple businesses, it’s likely not worth the effort to get a FinCEN ID#, so don’t worry about it.

How do I file my Beneficial Owner Information Report?

What you need before you file

In order to file your BOI Report, you will need the following information:

Your business’s entity name (and any DBAs) and current business address

Your business’s EIN (or other Tax Payer ID)

Residential addresses for all Beneficial Owners

A copy of a government ID (usually state issued drivers license) for each Beneficial Owner

This ID must match the owner’s current residential address. If the address on the ID does not match the current residential address, you will need to obtain a new ID prior to filing.

Where to file

You can file your Beneficial Owner Information Report easily online at fincen.gov/boi

SECTION 1 - Filing Information

For #1 Type of filing:

If this is the first time you are filing a BOI Report, select “Initial Report”.

If you are updating a previous report, select “Update Prior Report”

Click “Next” in the bottom right when you are finished.

Section 2 - REPORTING COMPANY

For #3, you likely do not need a FinCEN ID for your business so leave this unchecked.

Check #4 if you are “Foreign Pooled Investment Vehicle”

In #5 - Enter your business entity’s full legal name (including LLC, Inc, etc. — e.g. “Wolfe & Bosch PLLC”)

If your business has a registered DBA, enter it in #6. If you do not have a DBA, leave this blank.

For #7, select the business tax ID you are using (most likely an EIN) and enter your tax ID in #8 (#9 is only for foreign tax IDs)

For #10, select the state your business was first created/filed in (e.g. “Kentucky”)

In #11-15, enter your business’s current principal address

Click “Next” in the bottom right when you are finished.

Section 3 - Company Applicant

IMPORTANT!

In the Beneficial Owner Report, the “Applicant” is NOT the person filling out the BOI Report!!

The “Applicant” in the BOI Report is the person who originally filed your business entity. And by person, they literally mean “who submitted the paperwork to file your LLC”. So this could be an attorney who filed the LLC for you or one of the owners of the business if they filed it themselves.

Fortunately, if your entity was created prior to Jan 1st, 2024, you do not need to go back and find this information.

If your business entity was filed prior to Jan 1st, 2024:

Check the box in #16 Existing Reporting Company.

You will not need to fill out any information in this section.

Click “Next” to go to the next section.

If your business entity was filed on or after Jan 1st, 2024,

Do not check the box in #16. You will need to fill out the rest of this section.

If your Applicant has a FinCEN ID#, enter their ID number in #18 (this will save you from filling out the rest of this section).

Note: If an attorney filed your LLC for you, they probably have a FinCEN ID#—so reach out and ask.

If your Applicant does not have a FinCEN ID#:

Fill out the rest of this section. See Section 4 below for more detailed instructions on how to fill this out properly.

Click “Next” in the bottom right when you are finished.

Section 4 - Beneficial Owners

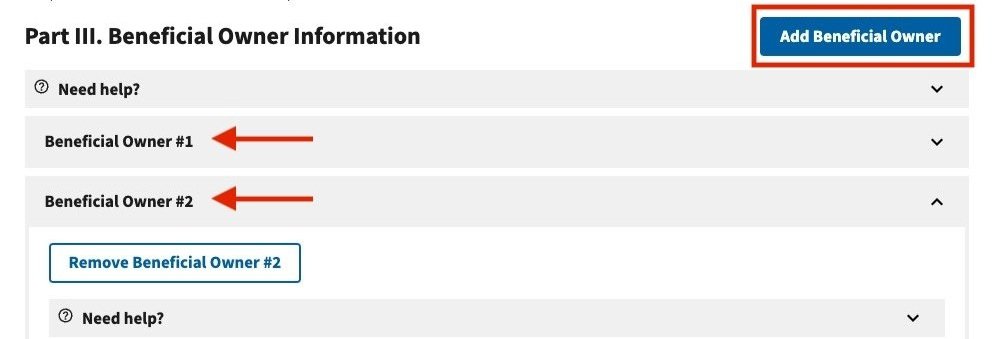

If there are more than one Beneficial Owners, click the “Add Beneficial Owner” button at the top right of this section to add the appropriate number of owners to this section.

Fill out #35-51 for each Beneficial Owner.

If the Beneficial Owner has a FinCEN ID#, enter it into #36. This will save you from filling out the rest of this form.

If the Beneficial Owner does not have a FinCEN ID#, Fill out #38-50 exactly as it appears on the government ID you are providing

NOTE: This must be the Beneficial Owner’s current residential address and must match the ID you provide. If your ID does not match your current residential address, you will need to obtain a new updated ID before you can submit.

Use #51 to upload a picture of your government ID (usually state issued drivers license).

NOTE: You do not need to include a photo of the back for state issued drivers licenses

Once you have completed filling out all information for all Beneficial Owners, click “Next” in the bottom right.

Section 5 - Submit

Enter your name and email address. Read the certification and compliance reminder and select “I agree” if you understand and agree.

Take the time now to go back and review all the information you have provided and confirm that it is correct. You will not be given a summary page to check before you submit.

Complete the Captcha to prove you are not a robot.

If all the information you provided is correct, you can, finally, click “Submit BOIR” to file your BOI Report.

Now What?

Congratulations! You have filed your Beneficial Owner Information Report.

As previously discussed, this is not a regularly recurring filing and not something you have to do every year.

However, if any of the information you provided in this report ever changes (See our list above for common examples) you are required to file an updated BOI Report within 30 days. You will follow the same process as above, but instead select “Update Prior Report” for #1 and complete the rest of the form as you just did.

If you have any questions, please feel free to email us at contact@wolfeboschlaw.com